Building A Budget

How to set a budget and stick to it

To put it simply, a budget is a plan for your money. Do you ever think of the amount you need to set aside each week for a large upcoming bill? Or do you choose the cheaper restaurant option because you ate at a more expensive choice last week? Those are both examples of budgeting, in a sense.

A more formal budgeting system is a complete layout of your income and expenses. In this system, you earmark all of your money for certain purposes. There are many budget calculators and worksheets, and everyone’s situation is different, so use a few to make sure you account for every expense. Resources are listed below, but these may not work perfectly for everyone.

There are three steps to creating a budget:

1. List all income and expenses

Make note of all income. Include any financial aid refunds, any living stipends, income from a job, the money you get from family, or anything else that you receive. If you have multiple sources of income, and they come in on different schedules, write down how often you receive each source of income (ex. “Internship income: $300/week, Financial Aid refund: $1000/every 3 months”).

Write down your monthly bills like rent, insurance, or your cell phone. Also, go through your receipts or bank statements for the past couple of months and write down all your regular purchases. If you normally spend $100 at Starbucks a month, write it down. A budget is not meant to necessarily change your habits, but to examine them and change them if they don’t align with your goals. Writing down all of your regular expenses will help you get a good idea of what you truly spend.

2. Compare what you make vs what you spend

Total up your income and compare it to the total of your expenses over a certain period. If you receive income every week, you may want your budget to be a weekly budget. If you only receive income once a month or biweekly, you may want to create a monthly budget. Do what works for you!

How do your income and expenses compare? Do you spend all of your money every period? Do you have money left over? Are you in the negative a few days after you receive your paycheck?

3.Create a future spending plan based on your current habits

Your goal is to create a plan for every dollar of your income, so if you have extra money left over each month, put more money into your savings account.

If you currently spend every penny or end up negative, evaluate if your spending habits match your financial goals. If you spend $300 on entertainment every month, but you end up having a hard time paying your rent often, see if you can cut down on entertainment.

Making a budget is not about reworking every single line item of your expenses. This is a common myth about budgeting and a large reason why many people are afraid to budget or are unable to stick to a budget. Instead, try to only alter your patterns that are negatively impacting you. If you can afford your Starbucks trips while saving for larger financial goals, you do not have to cut your coffee out. However, if you want to save up for a car and those trips are the only negotiable expense of your budget, try making coffee at home so you can earmark that money for a car instead.

Tips for Creating a Budget

- Set Financial Goals

Setting goals for your money will help get you interested in creating and sticking to your budget. Do you want to buy a car in the next five years? Pay off your student loans in a certain timeframe? Save up in case you don’t find a job right after college? Do you want to buy a designer bag or an expensive gaming system? Any financial goals you create are valid because they are important to you. Make these goals when you start a budget so you can plan your timeline for saving or paying off debt.

- Pay Yourself First

When listing your expenses, prioritize saving some of your income. Create an emergency fund (3 months of necessary expenses), and if you have a big-ticket item you’re looking to purchase in the future, creating a savings account to fund that goal as well.

- Don’t Forget About Your Debts

If you have a loan you pay on every month, or if you regularly rack up a credit card bill, don’t forget to include those expenses in your budget. Even if it’s not an expense you have every single month if it’s regular, you’ll want to include it. This just helps you make sure there are no surprises a few months down the road.

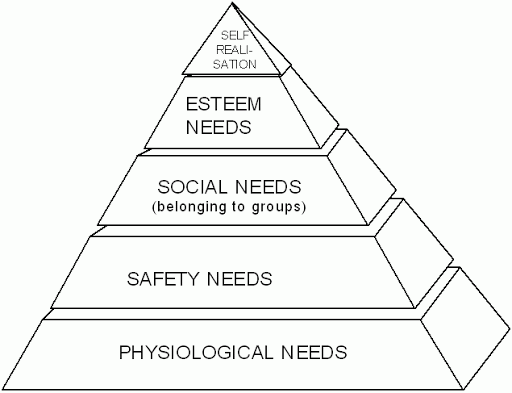

- Maslow’s Hierarchy of Needs

If you have to cut some expenses in your budget, or if you think you need to adjust your priorities, start by listing the nonnegotiable expenses, or “needs,” every month. This includes shelter and food, but may also include your transportation, insurance, sending money to family, or other expenses. Make sure you have enough income to cover these necessities before you allocate income to negotiable expenses, or “wants,” such as eating out, designer clothes, or subscription services.

If you struggle with deciding what is a want or a need, take a look at Maslow’s Hierarchy of Needs. Categorize your spending into the different levels, and see if that helps you prioritize where your money goes.

- Your Budget Can, and Should, Change

A budget you make in February may not apply to your spending in October. With birthdays, holidays, and other seasonal expenses, your budget should change with your spending. As long as you are on track to meet your financial goals, there is no shame in changing your budget.